Sitz: Helmholtzstraße 20

Master

Concept and department

The major subject “Accounting and Auditing” teaches the Master students an in-depth knowledge in the areas of national and international accounting, auditing and corporate tax law. In the courses the provision of standards and their implementation in practice and current research issues will be discussed.

Accounting is used for the provision of relevant information for the beneficiary of the annual financial statements by presenting all business transactions of the company according to the actual circumstances. The prepared financial statement serves as basis for the determination of profit. For tax calculation, the tax balance sheet is used.

In the lectures offered the relations as well as the differences between fiscal and commercial balance sheets in connection with economic and fiscal issues are discussed.

The auditors are responsible for the auditing of the accounting system and their conditional task is to carry out statutory audits of annual accounts. The auditor verifies the correctness of the financial statement and decides on granting or refusal of auditor's opinion. He also achieves a number of additional audit-related services. In addition to knowledge in the field of national and international accounting and auditing, skills in the area of business and tax law are necessary to perform these tasks.

With the combination of accounting, auditing and business law and taxation in research and teaching the Institute of Accounting and Auditing takes an essential development into account: the importance of accounting, in particular external financial reporting in view of the increasing internationalization and the increasing focus of management on the maximization of shareholder value will be even greater in future. A particular concern of the institute, therefore, is to link the areas of accounting, particularly with regard to external accounting, and auditing in research and teaching closely. Therefore English and German case studies, practical lectures in courses and excursions to companies ensure practical relevance in teaching. In this way an ongoing knowledge transfer between theory and practice is guaranteed.

Contact person

Sitz: Helmholtzstraße 20

Sitz: Helmholtzstraße 20

Courses/curricular programme and appointments

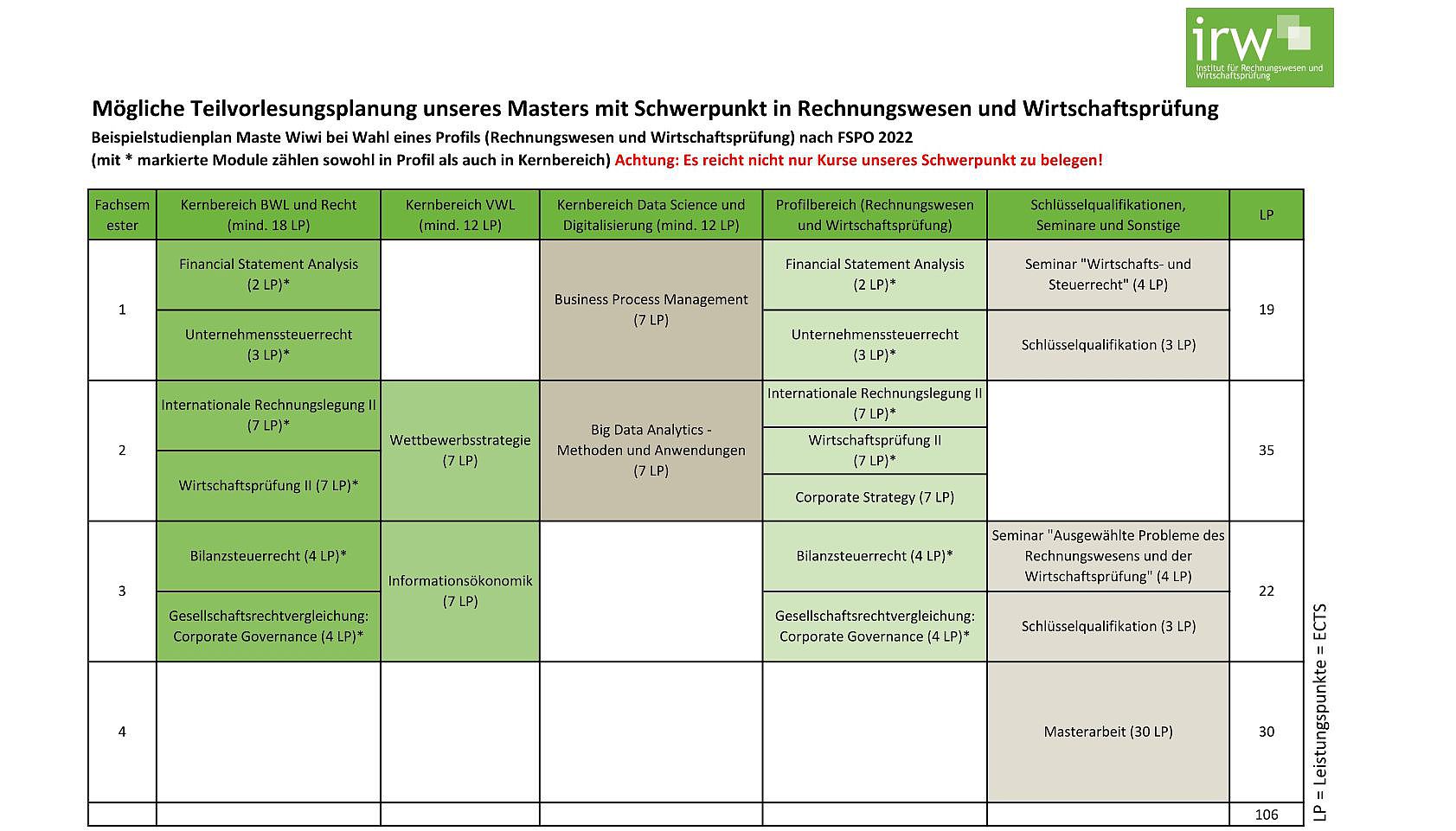

For Master's students specialising in "Accounting and Auditing", the coordinated courses represent a coherent and comprehensive training concept.

Having already acquired skills in accounting and auditing in the Bachelor's programme, the Master's programme aims to build on this knowledge. A corresponding specialisation in the Bachelor's degree is not mandatory, but recommended due to the knowledge required. For this purpose, the courses "International Accounting I and II" and "Auditing II - Selected Issues in Corporate Auditing" are offered regularly.

Training; (akad.: ) education in this specialisation serves to deepen and specialise the subject, with a focus on research-oriented work. Graduates are prepared for appointments in the internal areas of finance and accounting, auditing, business and tax consulting as well as for scientific work at a university.

Further notes

In the Master's degree programme, you have the option of choosing one or two specialisations. A total of at least 56 credit points (CP) must be earned from the examination areas of business administration/economics and the specialisation subject.

If you choose one specialisation subject, you must complete at least 21 credit points from the Business Administration and Economics examination area and at least 35 credit points from the specialisation subject. If you choose two specialisation subjects, you must complete at least 14 ECTS credits from the Business Administration and Economics examination area and a total of 42 credit points from the specialisation subject examination area. In addition, at least 18 ECTS credits must be earned in each specialisation.

As you can see from the sample study plan, you can achieve this through different subject combinations. Each of the specialisations offered (Economics, Computer Science, Financial Economics, Controlling and Insurance Economics) is a good complement to the Accounting and Auditing specialisation. You can also choose Accounting and Auditing as your sole specialisation, for which you will then have to earn 35 credit points. In addition to the lectures, sufficient seminars from the specialisation area are offered.

Master lectures offered (preliminary)

| Courses | Winter term 25/26 | SoSe 2026 | winter term 26/27 | SoSe 2027 |

| Financial Statement Analysis | ✓ | ✓ | ||

| Accounting for banks according to HGB and IFRS | ✓ | ✓ | ||

| International Accounting I | ✓ | ✓ | ||

| International Accounting II | ✓ | ✓ | ||

| Auditing II - Selected issues of business auditing and new auditing technology | ✓ | ✓ | ||

| Sustainability reporting | ✓ | ✓ | ||

| Corporate Strategy | ✓ | ✓ |