Sitz: Helmholtzstraße 20

Bachelor's degree

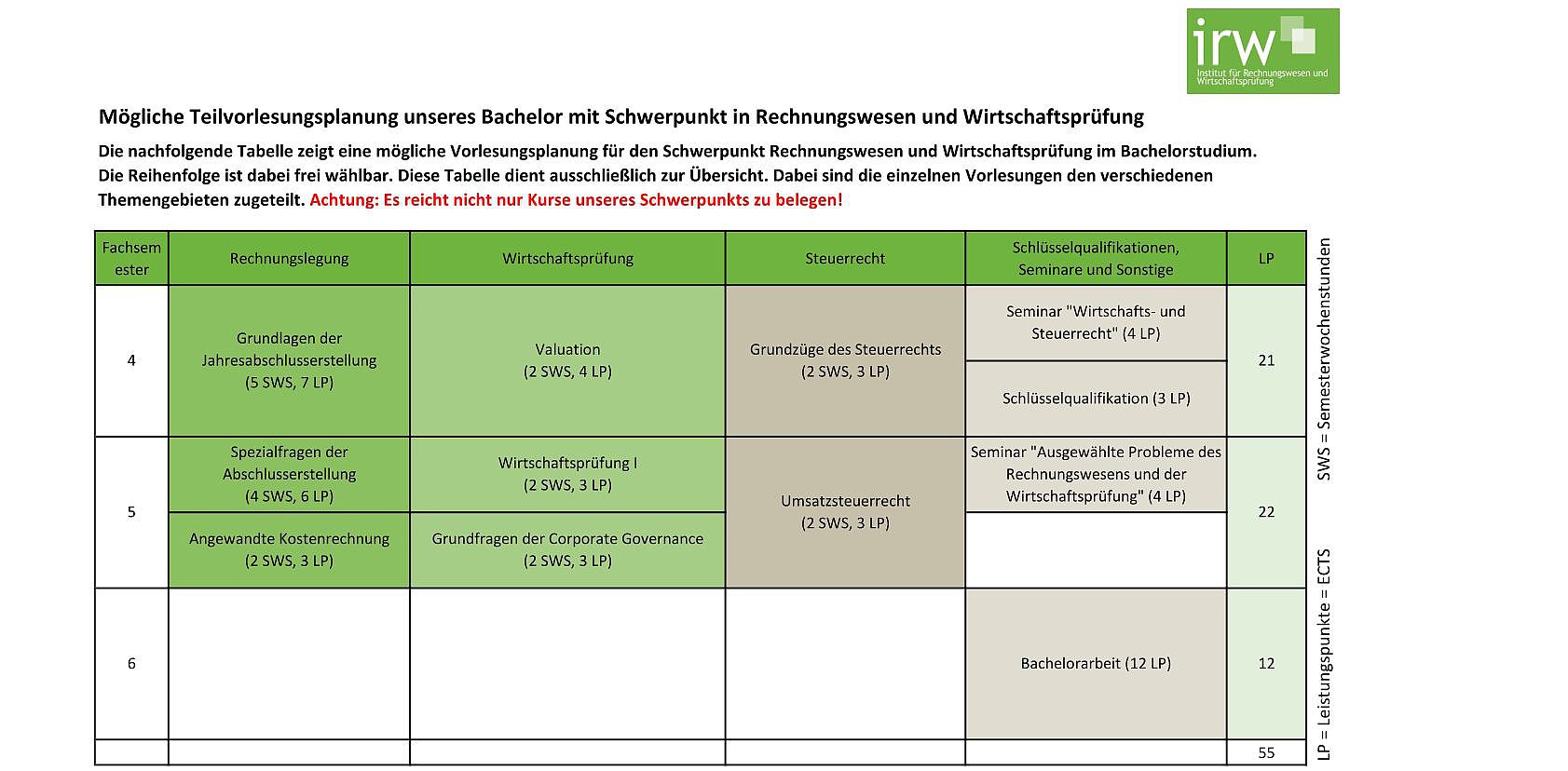

Why is it important to understand company figures correctly? How can you check whether an annual financial statement fulfils the legal requirements? And what role do international standards play in an increasingly globalised economic viability? We deal with these and many other questions in the "Accounting and Auditing" profile.

Accounting forms the backbone of the company information system:

All business transactions are documented in external accounting (bookkeeping & accounting).

Internal accounting (cost and performance accounting) provides the basis for economic viability decisions within the company.

Both areas are interlinked and are monitored by the audit. Auditors ensure that annual financial statements are correct and thus make an important contribution to transparency and trust in economic viability. Our institute combines accounting, auditing and tax law in research and teaching. This allows us to address current developments: With increasing internationalisation and the growing focus on company value and shareholder value, the importance of sound accounting is increasing.

Practical relevance is particularly important to us:

Case studies in German and English

Guest lectures by experts from corporate practice

Excursions to auditing and consulting firms

In this way, we ensure that students not only acquire the theoretical foundation, but also learn how to apply it in practice and are optimally prepared for their career start.

Contact person

Sitz: Helmholtzstraße 20

Sitz: Helmholtzstraße 20

Bachelor lectures offered (preliminary)

| Compulsory lectures | winter term 25/26 | summer semester 2026 | winter semester 26/27 | SoSe 2027 |

| External Accounting | ✓ | ✓ | ||

| Fundamentals of Civil Law including Private International Law and Labour Law (Part I) | ✓ | ✓ | ||

| Fundamentals of civil law including private international law and labour law (Part II) | ✓ | ✓ | ||

| Compulsory elective lectures | winter term 25/26 | summer semester 2026 | winter semester 26/27 | SoSe 2027 |

| Special issues in the preparation of financial statements | ✓ | ✓ | ||

| Basic issues of corporate governance | ✓ | ✓ | ||

| Auditing I | ✓ | ✓ | ||

| Applied cost accounting | ✓ | ✓ | ||

| Value added tax law | ✓ | ✓ | ||

| Fundamentals of preparing annual financial statements | ✓ | ✓ | ||

| Basics of tax law | ✓ | ✓ | ||

| Commercial law including international sales law | ✓ | ✓ | ||