Spatial risk analysis and risk modelling in property insurance

For a long time, there has been an ongoing discussion on the impact of the climate change on losses due to natural disasters. Past events like the hundred year flood in August 2002 and Hurricane Katrina in August 2005 have shown that the insurance industry has to spend billions of dollars to cover the resulting losses. Research on natural disasters indicates that even higher and more frequent claims have to be expected in the future.

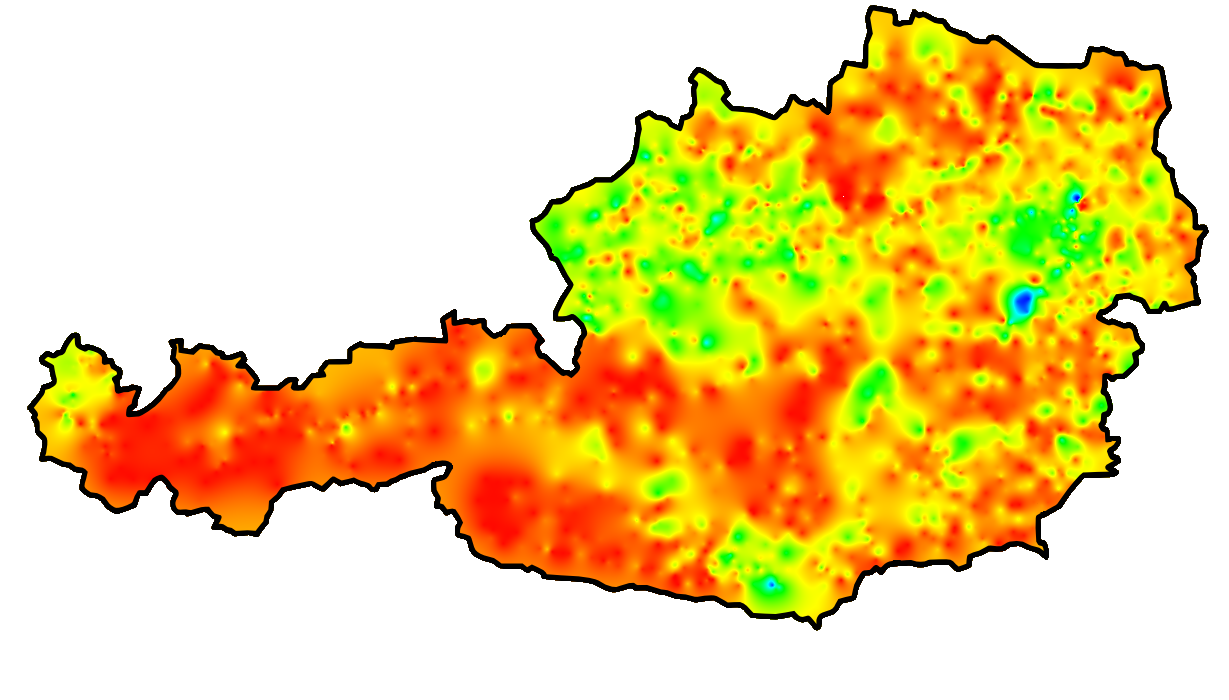

The research project aims at developing new mathematical approaches to analyze and model risk in property insurance spatially. In particular, the research focuses on analyzing and modelling major insurance claims. These claims are of great importance for insurance companies since they usually make up the major part of the total claim payments.

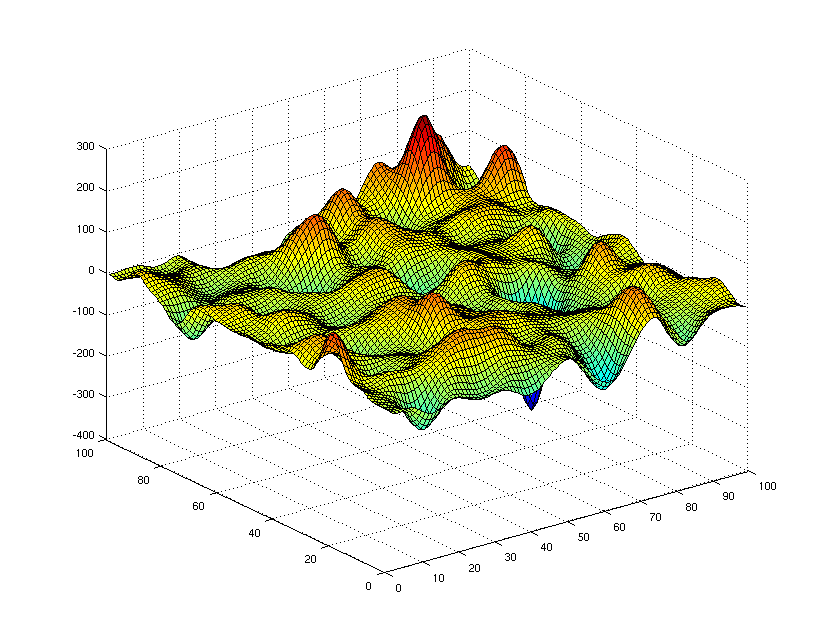

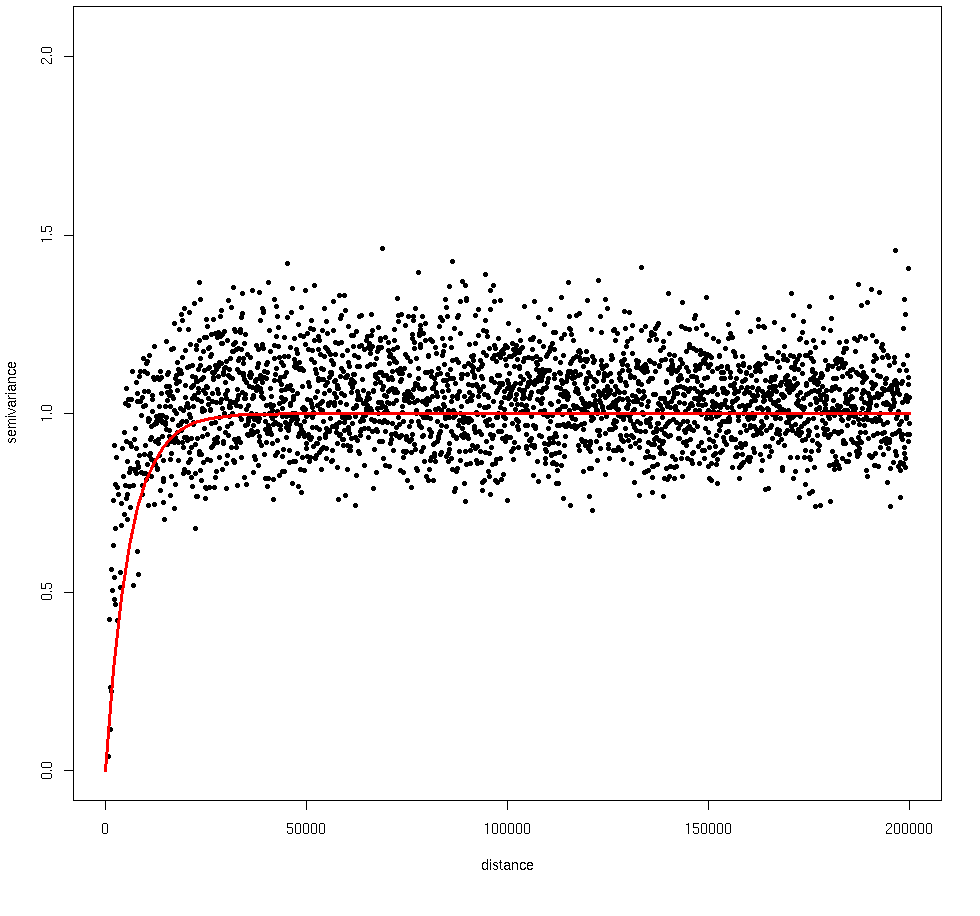

Opposed to classical (one-dimensional) risk theory, methods and models from image analysis, stochastic geometry and spatial statistics like Gaussian or α-stable random fields are applied in the research project. The goal is to assess the spatial risk situation over the next five to ten years based on spatial risk modelling and Monte-Carlo simulation in order to allow for regionalized premium rating. The project is kindly supported by Generali Wien AG.

Contact persons: Prof. Spodarev and Wolfgang Karcher